Financial Ratios Decoded for Real-World Success

Stop guessing about company performance. Our comprehensive approach breaks down complex financial metrics into practical insights that drive better business decisions.

Explore Learning Paths

Master the Numbers That Matter

Each financial ratio tells a different story about business health. Understanding these relationships gives you the analytical edge in any industry.

Liquidity Analysis

Current and quick ratios reveal short-term financial stability. Companies with ratios below 1.0 often face cash flow challenges within 12 months.

Profitability Metrics

Gross, operating, and net margins show how effectively management converts revenue into profit at each operational stage.

Efficiency Ratios

Asset turnover and inventory cycles demonstrate how well companies generate sales from their resource investments.

Leverage Assessment

Debt-to-equity and interest coverage ratios indicate financial risk levels and borrowing capacity for future growth.

Your Path to Financial Analysis Mastery

Foundation Building

Start with core accounting principles and financial statement structure. You'll learn to identify key data points and understand how different business activities impact reported numbers.

Ratio Calculation Skills

Master the mathematical relationships between financial statement items. Practice with real company data from various industries to build confidence with different calculation methods.

Industry Benchmarking

Learn to compare ratios across companies and sectors. Understand why a 15% net margin might be excellent in retail but concerning in software development.

Strategic Application

Apply ratio analysis to real business scenarios. Develop skills in trend analysis, competitor evaluation, and investment decision support that employers value highly.

Common Questions About Financial Ratios

These frequently asked questions address the practical concerns most people have when starting their financial analysis journey.

How do I know which ratios are most important for my industry?

Can financial ratios predict business failures?

What's the biggest mistake people make with ratio analysis?

How current should the financial data be for accurate analysis?

Learn from Industry Professionals

Our instructors bring decades of hands-on experience from corporate finance, investment analysis, and business consulting roles.

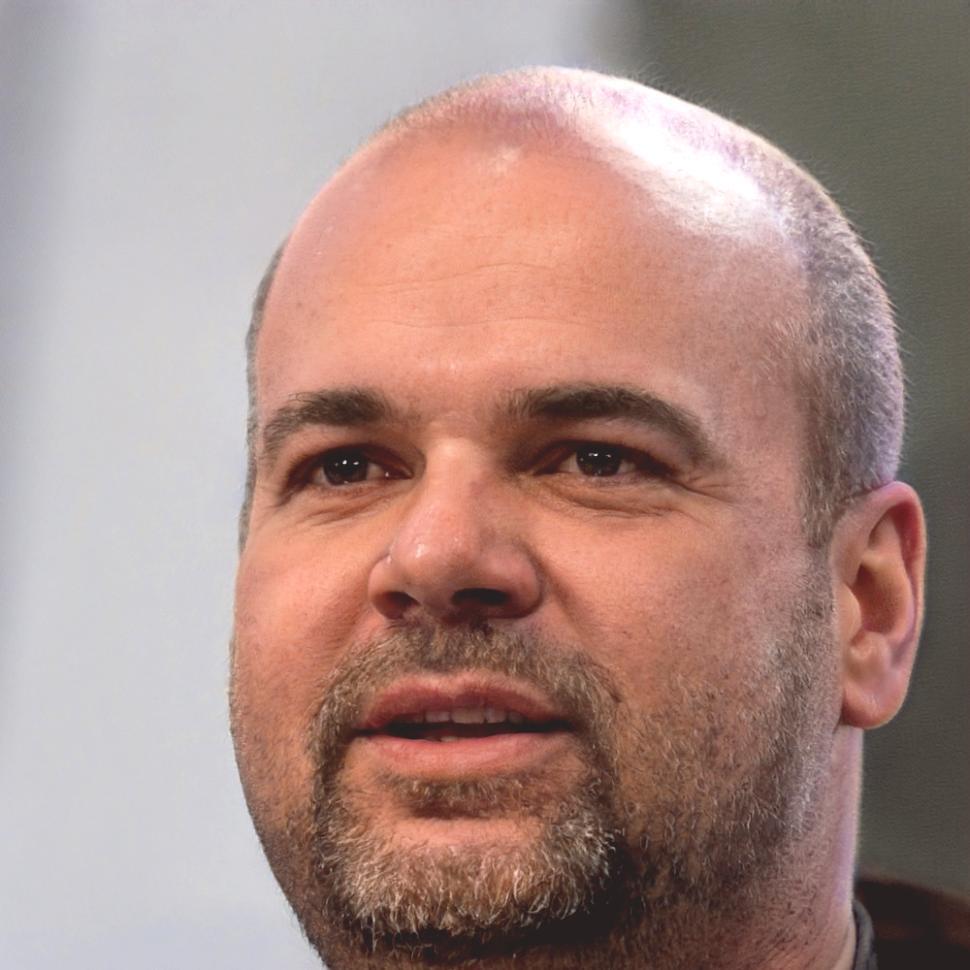

Marcus Webb

Senior Financial Analyst

Former investment banking analyst with 12 years experience evaluating company performance across technology and manufacturing sectors. Marcus specializes in teaching complex ratio relationships through practical case studies.

Roland Chen

Corporate Finance Director

Previously led financial planning teams at FTSE 100 companies, focusing on performance measurement and strategic analysis. Roland brings real-world perspective to ratio interpretation and industry benchmarking techniques.